Welcome to Ph.D. Voices, a monthly series in which Ph.D. candidates share their research with the antitrust world. The first entry is by Anouk van der Veer, Ph.D. candidate at the European University Institute.

****

Introduction

Once upon a time, companies like Google, Apple, and Meta were praised for their success. But the fairy tale has come to an end. Policymakers from all over the world are designing new regulations to complement antitrust agencies’ enforcement activities. They want to keep these companies ‘in line.’ But how out of line are they? Traditional competition law—with its strong focus on price competition, perfect substitutes, and market shares—sees large tech companies as “super-dominant”. A deep dive into tech circles reveals a different story where innovation is central, and the competitive pressure is intense.

Let me take the Google Shopping case as an example. In 2017, the Commission decided that Google abused its dominant position by favouring its own shopping comparison product over competing services. The General Court confirmed the decision in November 2021. According to the Commission—and the Court—Google’s relevant market does not include merchant platforms like Amazon.com due to limited substitutability between comparison shopping services and merchant platforms. Yet consumers use both Google and Amazon to search for products. In fact, consumers report using Amazon more often as a starting point [1, 2, 3]. How come market definition excludes Amazon from Google Shopping’s relevant market? Traditional market definition only considers perfect substitutes. The Commission acknowledges substitutes and complements but never computes these in the analysis.

Now, looking at general search services, the Commission found high barriers to entry. From a static competition perspective, entry barriers are high indeed. However, potential competition does not only come from those wishing to offer a new general search service. It also comes from substitutes and complements. In July 2022, for example, Instagram introduced a searchable map that shows popular locations and allows users to filter location results by specific categories, including restaurants and hotels. Here, Meta does not challenge Google as a general search service but as a provider of local search features. Another example coming from Meta is the introduction of Instagram Shopping in 2019. With Instagram Shopping, users can buy a product without leaving the app. A year after its introduction, Adidas CEO Kasper Rørsted attributed most of the company’s 40% increase in sales to Instagram Shopping. Even though Instagram does not qualify as a traditional merchant platform, it still manages to compete with merchant platforms.

A new storyline: dynamic competition

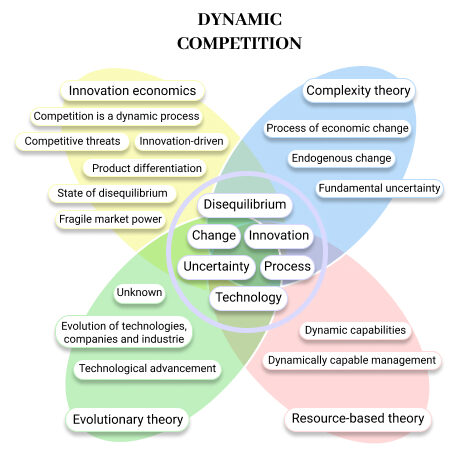

Against this background, there is an urgent call to take dynamic competition seriously. Dynamic competition is not a theory devised to favour today’s large tech companies. Instead, dynamic competition dates back decades. The long history has yielded a vague umbrella concept that encompasses everything non-static. To understand the concept, let’s go back to the beginning: what does dynamic competition oppose: neoclassical economics as the sole guide for competition law assessments. And what does dynamic competition propose? Improvements for those assessments drawn from (i) innovation economics, (ii) evolutionary theory, (iii) complexity theory, and (iv) resource-based theory.

Dynamic competition draws on innovation economics as defined by Austrian School economists, e.g., Schumpeter and Hayek. Whereas neoclassical economics focuses on reaching economic equilibrium, Austrian economists see competition as a process in a state of disequilibrium. By extension, elements such as products, demand, and supply should not be taken as static data. These elements are subject to constant change due to companies striving for innovation and growth rather than economic efficiency.1Friedrich A. Hayek, ‘The Meaning of Competition’ (1948) 94 Individualism and Economic Order. See Gregory Sidak and David J. Teece, ‘Dynamic competition in antitrust law’ (2009) 5/4 Journal of Competition Law & Economics; Nicolas Petit and David J. Teece, ‘Big Tech, Big Data, And Competition Policy: Favoring Dynamic Over Static Competition’ (2021). Dynamic competition looks at competition coming from “the new commodity, the new technology, the new source of supply, the new type of organization”.2Joseph A. Schumpeter, Capitalism, Socialism and Democracy [1942] (Routledge 2010) 74.

Evolutionary theory helps to understand the process of economic change through biological analogies.3Richard Nelson, ‘Economics from an Evolutionary Perspective’ in Modern Evolutionary Economics: An Overview (Cambridge University Press 2018). Richard R. Nelson and Sidney G. Winter, An Evolutionary Theory of Economic Change (Harvard University Press 1982); Giovanni Dosi and Richard R. Nelson, ‘An introduction to evolutionary theories in economics’ (1994) 4 Journal of Evolutionary Economics. Instead of assuming that the biggest companies (species) survive, evolutionary theory studies how and under which conditions the fittest companies can survive. When applied to digital markets, evolutionary theory highlights how Facebook became a better fit for users when it allowed interaction on a single webpage, whereas MySpace required opening multiple tabs.4Read more about beneficial lock-in here, Nicolas Petit and Thibault Schrepel, ‘Complexity-Minded Antitrust’ (2022) VU University Amsterdam Legal Studies Paper Series.

Complexity theory helps better understand how economies (ecosystems) develop. First, companies often find themselves in a state of fundamental uncertainty. In these circumstances, problems are ill-defined, forcing companies to explore and continually alter their behaviour and strategies in reaction to the outcomes they co-create. Managers cannot solve these problems rationally but need to develop an understanding of the undefined situation in a complex environment and position themselves accordingly.

Second, complexity economics contributes to understanding the behaviour of companies. The aggregation of behaviour creates a pattern to which companies adapt. For example, companies constantly adjust their buying decisions, prices, and predictions to the situation that these decisions, prices, or predictions create. A continually changing environment compels companies to deviate from what has worked in the past, venture into uncharted waters, and act outside of calculus.5Kim B. Clark, ‘The Interaction of Design Hierarchies And Market Concepts In Technological Evolution’ (1985) 14/5 Research Policy; W. Brian Arthur, ‘Complexity and the economy’ (1999) 284 Science.

The last source dynamic competition draws from is strategic management theories, specifically, resource-based theory. The resource-based theory attributes a competitive advantage to the companies with a set of valuable, not easily duplicated, and appropriable resources. Resource-based theory underscores that market winners, in addition, often show strong dynamic capabilities. Dynamic capabilities are the firm-specific skills that companies themselves need to build, maintain, and improve, and cannot be bought or taught. Hence, these capabilities provide a source of differentiation that allows companies to achieve a competitive advantage in highly competitive environments.6David J. Teece, Gary Pisano, and Amy Shuen, ‘Dynamic Capabilities and Strategic Management’ (1997) 18 Strategic Management Journal; David J. Teece, ‘Explicating Dynamic Capabilities: The Nature and Microfoundations of (Sustainable) Enterprise Performance’ (2007) 28 Strategic Management Journal; David J. Teece, ‘The foundations of enterprise performance: dynamic and ordinary capabilities in an (economic) theory of firms’ (2014) 28/4 Academy of Management Perspectives. Resource-based theory thus highlights the importance of companies’ management.7David J. Teece, ‘Dynamic Capabilities and Entrepreneurial Management in Large Organizations: Toward a Theory of the (Entrepreneurial) Firm’ (2016) 86C European Economic Review.

What makes competition dynamic

From these clusters of theories, I wish to create a comprehensive and actionable theory of dynamic competition.

A theory of dynamic competition focuses on processes in a state of disequilibrium where competition is innovation-driven, leading to product and technology differentiation. It emphasises that companies endure competitive threats that push them to innovate and introduce these differentiations. It explains how surviving companies capture the benefits of these innovations; then emerge as market leaders. It highlights that the changing business environment requires surviving companies to change their behaviour, strategies, and expectations, which puts them in a state of fundamental uncertainty. A theory of dynamic competition shows that achieving and sustaining competitive advantage requires companies to manage strong dynamic capabilities and have a dynamically capable management.

Dynamic competition is not pro or anti-enforcement. Instead, it points toward a change in how enforcement takes place. The analysis should question the impact of behaviour and transactions on the drivers of innovation-driven competition, such as fundamental uncertainty and dynamic capabilities. Consider, for example, Facebook’s acquisition of Instagram. At first glance, it could appear as if a competitor who might use disruptive technology to challenge Facebook has disappeared. But one could question if Instagram had the dynamic capabilities to compete effectively. The same holds true for Facebook/Giphy. Being a potential technology competitor is one thing; having the capabilities to make it happen is quite another.

Conduct and transactions that look suspicious under a static lens may be innocent from a dynamic perspective. Meanwhile, behaviour that harms dynamic competition may have more adverse and lasting effects on consumer welfare than those undermining static competition. With dynamism in mind, a more truthful picture of market competition emerges, and with that, better enforcement of competition law.

Anouk van der Veer

I am indebted to Thibault Schrepel and Nicolas Petit

***

Citation: Anouk van der Veer, Calling For a New Theory of Dynamic Competition, Network Law Rev. (September 21, 2022)